Tips and Guides

Refinance Home Loan For People With Student Loan Debt – 10 Necessary Conditions

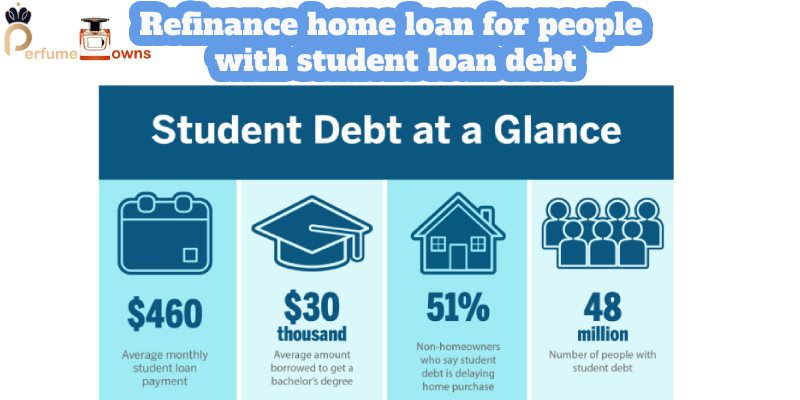

Refinance home loan for people with student loan debt. What requirements do we need to meet? How is the family rule carried out? In this article, we will answer them all.

Refinance home loan for people with student loan debt

The necessary conditions to be able to restructure a home loan

Sufficient Equity

Please follow the article to get the most accurate answer.? Lenders often require homeowners to have certain equity in their home before they can refinance. Equity is the difference between the home’s current market value and the remaining mortgage balance. A higher equity position may result in more favorable refinancing terms.

Creditworthiness

A good credit score is essential for securing favorable interest rates and terms when refinancing. Lenders typically look for a credit score that demonstrates a borrower’s ability to manage credit responsibly.

Stable Income

Lenders evaluate the borrower’s ability to repay the loan, which frequently includes establishing a consistent and sufficient income. Meeting monthly mortgage payments requires a regular income stream.

Debt-to-Income Ratio

Lenders assess borrowers based on their debt-to-income ratio, which compares total monthly debt payments to gross monthly income.

Reasonable Loan-to-Value Ratio (LTV)

The loan-to-value ratio is the ratio of the loan amount to the appraised value of the property. Lenders may have specific requirements regarding the maximum allowable LTV for refinancing.

Up-to-Date Mortgage Payments

A history of timely mortgage payments is crucial. Lenders typically prefer borrowers who have a record of consistent, on-time payments.

Employment Stability

Lenders may consider the borrower’s employment history and stability. A stable employment record can enhance the borrower’s credibility and ability to repay the loan.

Appraisal of the Property

Lenders often require a new appraisal of the property to determine its current market value. The appraisal helps assess the loan amount and the property’s value.

Refinance home loan for people with student loan debt? Continue reading the article.

Adequate Documentation

Borrowers need to provide necessary documentation, including proof of income, tax returns, and other financial documents. Proper documentation is crucial for the refinancing process.

Loan Type and Terms

The existing loan type and terms may influence eligibility for refinancing. Some loans may have prepayment penalties or specific conditions that affect the feasibility of refinancing.

You know: Refinance home loan for people with student loan debt. Please follow the article to get the most accurate answer.

Loan Restructuring Process

The loan restructuring process involves making adjustments to the terms of an existing loan to better align it with the borrower’s financial circumstances. Here’s a general overview of the loan restructuring process.

Assessment of the Financial Situation

The borrower assesses their current financial situation, identifying challenges that necessitate restructuring. This could include a reduction in income, unexpected expenses, or other financial hardships.

Contact the Lender

The borrower contacts the lender as soon as they foresee financial difficulties. Early communication is crucial in demonstrating a proactive approach to addressing the issue.

Understanding Available Options

Refinance home loan for people with student loan debt? The lender provides information about potential restructuring options available to the borrower. These options could include modifying the interest rate, extending the loan term, or temporarily adjusting the payment schedule.

Documentation Submission

The borrower submits the necessary documentation to support their request for loan restructuring. This documentation may include proof of income, financial statements, and a hardship letter explaining the reasons for the request.

Lender’s Assessment

The lender reviews the borrower’s financial documentation and assesses the feasibility of loan restructuring. They consider the borrower’s ability to meet the modified terms and whether the proposed adjustments align with the lender’s policies.

Negotiation of Terms

The lender and borrower engage in negotiations to determine the modified terms of the loan. This may involve discussions about interest rates, loan duration, and any other relevant conditions.

Approval and Agreement

Once an agreement is reached, the lender formally approves the loan restructuring. Both parties sign a written agreement outlining the modified terms, and this agreement becomes a legally binding contract.

Implementation of Changes

The lender implements the agreed-upon changes to the loan terms. This may involve updating the loan agreement, recalculating the repayment schedule, or making other adjustments as outlined in the restructuring agreement.

Monitoring and Compliance

Both the lender and borrower monitor the loan after restructuring to ensure that the modified terms are being adhered to. Regular communication between the parties is essential, and the borrower must continue to meet the revised payment obligations.

Completion of Restructuring

Once the borrower successfully complies with the restructured terms, the restructuring process is considered complete. The loan is then managed based on the new terms until it is fully repaid.

Advice for those wanting to restructure their loans

Refinance home loan for people with student loan debt? If you’re considering restructuring your loans, it’s essential to approach the process thoughtfully and strategically. Here are some pieces of advice for those wanting to restructure their loans.

Assess Your Financial Situation

Conduct a comprehensive review of your financial situation. Understand the reasons behind the need for restructuring and have a clear picture of your income, expenses, and outstanding debts.

Communicate Early with Lenders

Contact your lenders as soon as you anticipate financial challenges. Early communication allows you to explore restructuring options before the situation becomes critical, increasing the likelihood of finding viable solutions.

Understand Available Options

Familiarize yourself with the potential restructuring options offered by lenders. This may include interest rate modifications, changes to the loan term, or other adjustments. Understanding these options empowers you to make informed decisions.

Gather Necessary Documentation

Be prepared to provide the required documentation to support your request for loan restructuring. This may include proof of income, financial statements, and a detailed explanation of the challenges you’re facing.

Be transparent and honest.

Transparency is key during the restructuring process. Be honest with your lenders about your financial situation, explaining the factors contributing to your difficulties. Lenders are more likely to work with you if they understand your circumstances.

Negotiate Realistic Terms

When negotiating with lenders, propose realistic terms that you can reasonably meet. Consider factors such as your current income, future financial prospects, and other obligations. Realistic terms increase the likelihood of a successful restructuring.

Seek Professional Advice

Consider consulting with financial advisors or credit counselors who can guide the restructuring process. They can offer insights into the potential impact of different restructuring options on your overall financial health.

Prioritize High-Interest Debts

If restructuring involves consolidating debts, prioritize high-interest debts. This can help reduce overall interest costs and streamline debt repayment.

Continue Making Payments

While the restructuring process is ongoing, continue making timely payments on your existing loan obligations. This demonstrates good faith and financial responsibility toward lenders.

Monitor Your Credit

Be aware of the potential impact of loan restructuring on your credit score. While restructuring itself may not have a severe negative impact, staying informed about your credit situation is crucial for your overall financial health.

Educate Yourself on Terms and Conditions

Before finalizing any restructuring agreement, thoroughly understand the terms and conditions. Be aware of any potential fees, changes to interest rates, and how the restructuring will affect your overall repayment.

In conclusion

Surely you already know: Refinance home loan for people with student loan debt. The home loan restructuring process not only relieves financial stress caused by student debt, but also provides numerous additional advantages. It is a critical step in ensuring that you not only live in the now but also construct a strong and wealthy future for yourself.